With secure fintech apps that simplify payments, investments, and lending

Free Consultation

Proven Excellence With Recognized Credentials

Serving Ambitious Startups to Global Enterprises with Equal Dedication

Successive Years

Top Tier Expertise

YOY Revenue Growth

Client Retention

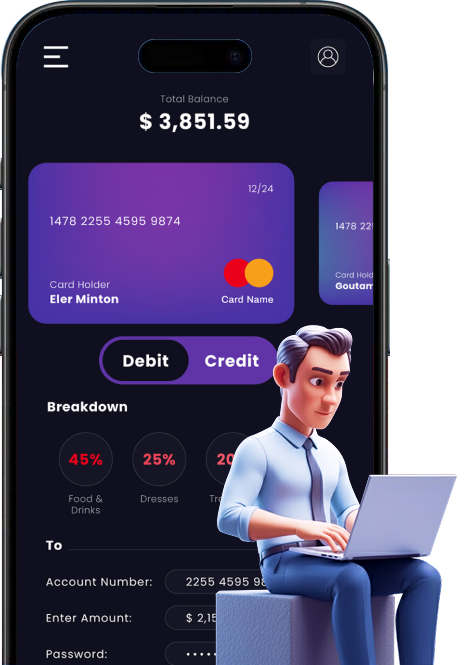

From digital wallets to investment platforms, we design robust fintech solutions aligned with global standards that optimize performance and steer businesses to thrive in the technology-driven financial world.

As a recognized fintech app development organization, we take responsibility for ensuring the highest levels of quality and compliance in every solution we deliver.

We make sure that all fintech applications and platforms adhere to prescribed international and governmental standards across the world, safeguarding trust, security, and reliability.

Empower your digital finance ecosystem with intelligent features like automated risk analysis, blockchain-backed transparency, and multi-layer security, ensuring smarter operations and greater trust across all financial transactions.

Our fintech projects deliver reliability, compliance, and innovation. Each project showcases how we blend cutting-edge technology with financial expertise to create secure, scalable, and performance-driven applications for the ever-evolving digital finance ecosystem.

Whether you're launching your first competitive title or upgrading an existing game for esports readiness, we help you deliver high-performance, globally scalable, & commercially viable games.

Free ConsultationWe leverage advanced technologies, modern frameworks, and secure architectures to build fintech applications that ensure performance, compliance, and scalability across digital banking, payments, lending, and wealth management platforms.

Every fintech project is unique. We offer transparent and customized cost estimations that align with your business goals. Our process ensures you get an accurate projection of development expenses while maximizing value, efficiency, and long-term returns on your fintech investment.

When determining the budget for your fintech application development solution, we take into consideration factors like:

Our fintech app development team offers a comprehensive suite of solutions, all of which are tailored to your business needs and are integrated with the latest features.

We offer complete app design and branding solutions as part of our app development services. Designers craft visually appealing, user-centric interfaces that reflect your brand identity while ensuring intuitive navigation and smooth interactions across devices.

Yes, we help clients define their product vision, prioritize features, and build investor-ready MVPs tailored to market needs.

Definitely. We use secure APIs and middleware to connect modern fintech platforms with traditional banking infrastructure.

Yes, we provide customizable white-label platforms for:

These can be branded and launched quickly.

We implement seamless onboarding flows with:

Yes, we build globally scalable platforms with multi-currency support, multilingual interfaces, and region-specific compliance.

Absolutely. We integrate major payment gateways based on your business model and target markets.

We focus on intuitive, secure, and conversion-optimized interfaces that build trust and simplify financial workflows.

Yes, we handle:

We provide secure sandbox setups for testing transactions, compliance workflows, and third-party integrations before going live.

Yes, we develop role-based dashboards with:

Yes, we can connect your fintech app with enterprise systems to streamline operations and improve customer engagement.

We use:

—to maintain reliability and speed under heavy usage.

Yes, we provide:

to support fundraising and audits.

We guide financial institutions through digital transformation with strategy, architecture planning, and implementation support.

We work across: