Hiring a game development company is rarely just about building a game. For startups, it determines whether an idea reaches the market before resources run out. For enterprises, it determines whether scale introduces stability or friction.

This guide is written for founders, product leaders, and enterprise decision-makers who want clarity, not sales pitches. Instead of listing generic best practices, it explains what works, when it works, and when it breaks down, the perspective most hiring guides miss.

Why Startups and Enterprises Must Hire Differently

Hiring approaches that work for startups often fail at enterprise scale. Enterprise hiring practices, in turn, can suffocate early-stage innovation.

For startups, hiring a game development company works best when the partner can operate amid uncertainty (unclear mechanics, evolving monetization, and rapid iteration). This approach fails when vendors demand frozen scopes too early, turning experimentation into contractual friction.

For enterprises, structured delivery models work when requirements, governance, and internal processes are clearly defined. They fail when vendors underestimate coordination overhead, security reviews, or approval cycles.

The first hiring decision, therefore, is not who is best, but who fits your current stage.

The Core Hiring Mistake: Optimizing for the Wrong Risk

Most buyers believe cost or speed is the primary risk. In practice, misalignment is the real risk.

Hiring based on speed works when requirements are stable and decisions are centralized. It fails when feedback loops are long or when stakeholders are distributed. Hiring based on low cost works when the scope is tightly controlled. It fails when iteration becomes inevitable.

Experienced buyers evaluate game development companies based on which risk they reduce:

- Delivery risk

- Technical debt risk

- Organization risk

- Post-launch risk

A vendor that cannot articulate which risks they actively manage is unlikely to manage them well.

Startup Hiring Strategy: When Flexibility Is Non-Negotiable

Hiring lightweight, adaptable teams works when the product is still being validated. It fails when startups over-index on speed without ownership.

Startups benefit most from partners who can work with partial documentation, shifting priorities, and feedback-driven iteration. This approach breaks down when startups hire large teams too early, creating communication overhead and unnecessary burn.

Hiring dedicated developers works when there is continuity and shared context. It fails when developers are rotated frequently, forcing teams to relearn the product repeatedly.

At this stage, the goal is not scalability. It is learning efficiency: how quickly insights translate into playable improvements without locking the product into rigid architecture.

Enterprise Hiring Strategy: When Predictability Matters More Than Velocity

Enterprise-grade engagement models work when delivery predictability is more important than experimentation. They fail when vendors promise agility without process maturity.

An enterprise game development company should be evaluated on how it handles:

- Dependency management

- Cross-team communication

- Documentation discipline

- Risk escalation

Enterprises often struggle not because vendors lack skill, but because vendors lack operational maturity. Teams that cannot integrate into structured environments eventually become blockers, regardless of technical capability.

For enterprises, selecting a scale game studio is about confidence under complexity, not optimism under pressure.

Evaluating Technical Depth Without Technical Bias

Judging vendors by toolsets alone works when technology choice is the main differentiator. It fails when buyers mistake buzzwords for depth.

Strong game development companies explain why they choose certain engines, architectures, or pipelines, and what trade-offs those choices introduce. Weak vendors focus on what they use, avoiding discussions about limitations.

A useful evaluation heuristic is simple:

If a vendor cannot clearly explain where their approach might struggle, they likely haven’t tested it at scale.

Engagement Models: What Works and Where Each One Breaks

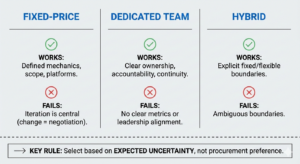

Fixed-price engagements work when gameplay mechanics, content scope, and platforms are well defined. They fail the moment iteration becomes central, turning every change into a negotiation.

Dedicated team models work when ownership, accountability, and continuity are clear. They fail when teams operate without clear success metrics or leadership alignment.

Hybrid models work for long-running programs when boundaries between fixed and flexible components are explicit. They fail when those boundaries remain ambiguous.

The engagement model should be selected based on expected uncertainty, not procurement preference.

Team Structure: Continuity Over Headcount

Large teams work when parallelization is possible, and coordination costs are managed. They fail when communication overhead outweighs execution speed.

Smaller, stable teams work when context retention and decision velocity matter. They fail when capacity planning is ignored and delivery expectations outpace team size.

When buyers hire dedicated game developers, the real question is not how many developers are assigned, but how long they stay assigned.

IP Ownership and Control: Where Problems Surface Too Late

Loose IP teams work when projects are disposable. They fail when products become valuable. Startups often discover IP issues during fundraising. Enterprises discover them during audits or vendor transitions. By then, remediation is costly.

Clear ownership, licensing clarity, and exit terms should be addressed upfront, not treated as legal formalities.

Communication as a Risk Signal

Minimal communication works when the stakes are low. It fails when timelines tighten or post-launch issues emerge.

Mature game development companies maintain predictable reporting, escalate risks early, and document decisions consistently. These behaviors matter more than tooling or methodology labels.

If communication feels reactive during evaluation, it will feel chaotic during delivery.

Post-Launch Reality: Where Many Vendors Fall Short

Treating launch as the finish line works for demos. It fails for products. Startups need rapid iteration after launch to refine engagement and retention. Enterprises need LiveOps readiness, stability, and content pipelines.

A vendor’s post-launch mindset reveals whether they link in milestones or in product lifecycles.

How Experienced Buyers Make the Final Decision

Selecting a scalable game studio is not about selecting the most impressive portfolio. It’s about selecting the partner whose strengths align with your risks.

The strongest signal is not confidence; it is measured honesty. Vendors who openly discuss constraints, trade-offs, and failure scenarios are more likely to deliver under pressure.

Why Some Teams Choose Red Apple Technologies

Red Apple Technologies is often considered by startups and enterprises looking for a partner that operates between early-stage flexibility and enterprise-grade delivery discipline.

Their approach tends to work well when projects require:

- Stable, long-term teams rather than short-term execution bursts

- Clear communication across technical and non-technical stakeholders

- Support beyond initial development, including LiveOps and post-launch scaling

This model may not suit teams looking for rapid, one-off builds with minimal collaboration. However, for organizations prioritizing continuity, risk visibility, and structured growth, Red Apple Technologies aligns with projects where predictability and adaptability need to coexist.

Conclusion

This hiring guide for startups & enterprises is built on one principle:

Good decisions come from understanding where approaches stop working.

By focusing on risk alignment, operational maturity, and lifecycle thinking, buyers can select a scalable game studio that fits not just today’s needs—but tomorrow’s realities.

The best partnerships are not the fastest to start. They are the hardest to replace.

To Have A Better Understanding On This Let us Answer The Following Questions

Answer: Hiring externally works best when speed, flexibility, and access to specialized skills matter more than long-term team ownership. It fails when startups outsource core decision-making without retaining product control. If gameplay direction and iteration priorities remain internal, external teams accelerate learning without locking you into premature hiring.

Answer: Scalability works when the vendor has experience supporting post-launch updates, LiveOps, and growing content pipelines. It fails when teams are structured only for pre-launch delivery. Ask how they handle team continuity and workload changes after launch; the answer reveals whether they think in milestones or product lifecycles.

Answer: Dedicated teams work when requirements are expected to evolve and continuity matters. Fixed-price models work when scope is stable and iteration is limited. Fixed pricing fails quickly once gameplay feedback drives change, while dedicated teams fail when ownership and accountability are unclear.

Answer: Enterprise engagements fail when vendors underestimate coordination complexity, approval cycles, or internal integrations. They succeed when the partner is comfortable operating within structured environments and communicating risks early rather than masking them with optimistic timelines.

Answer: Post-launch planning matters when the product is expected to evolve through updates, balance changes, or live content. It becomes a failure point when vendors treat launch as the finish line. Buyers should confirm how LiveOps, maintenance, and performance monitoring are handled before signing.

Answer: Ask how the vendor handles mid-project team changes, shifting priorities, or unexpected technical constraints. Strong partners explain trade-offs and mitigation strategies. Weak ones deflect or overpromise, often the first warning sign.

Answer: Communication maturity shows up during pre-sales. Clear documentation, structured updates, and early risk disclosure indicate operational discipline. Poor communication during evaluation rarely improves after contracts are signed.

Answer: IP Ownership becomes critical when products gain traction, attract investors, or need long-term maintenance. Loose agreements work only for disposable projects. For startups and enterprises alike, unclear IP terms surface as costly problems later, not at project start.

Answer: Long-term partnerships work when the vendor understands the business context, not just technical tasks. They fail when delivery is treated as a sequence of disconnected milestones rather than a product lifecycle.

Answer: No evaluation process eliminates risk completely. However, vendors who openly discuss constraints, limitations, and failure scenarios tend to perform better under pressure than those who focus solely on confidence and speed.

Book an Appointment

Book an Appointment Get Instant Project Estimation

Get Instant Project Estimation WhatsApp Now

WhatsApp Now

Book An Appointment

Book An Appointment WhatsApp

WhatsApp