In the past few years, there has seen a noticeable increase in esports worldwide. Factors like high-speed 5G networks and affordable equipment have attracted a large section of gamers, turning competitive gaming into a mega esports business and opened the way for investors to make fancy earnings. Thousands of players among the 3B+ gamers globally make a full-time living from their gaming skills.

This guide is designed for those wanting to understand how profitable investing in esports is. From budding start-ups to multi-billion-dollar corporations, let’s talk about investment opportunities, analyzing possibilities and pitfalls.

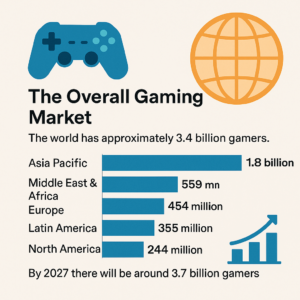

The Overall Gaming Market

Gaming is undoubtedly the biggest success story in global entertainment. Unlike traditional entertainment industries, gaming has scaled rapidly across geographies, demographics, and devices. The world has approximately 3.4 billion gamers, and the number’s growing steadily.

Let’s look at which region’s gotten how many:

| Region | Number of Gamers |

|---|---|

| Asia Pacific | 1.8 billion |

| Middle East & Africa | 559 million |

| Europe | 454 million |

| Latin America | 355 million |

| North America | 244 million |

It is expected that by 2027 there will be around 3.7 billion gamers worldwide. Currently, the video games market is worth $187.7 billion, with estimations of it rising up to $213.3 billion by 2027.

The market is led by industry giants like Sony, Tencent, and Microsoft, followed by an overwhelming number of mid-sized studios, independent developers, and startups. Many of these are at the forefront of esports, an era-defining genre that has transformed multiplayer gaming into one of the most watched forms of entertainment worldwide.

Esports is Redefining Competitive Gaming

What began in internet cafés as small-scale LAN competitions has evolved into stadium-filling events, streaming broadcasts with millions of concurrent viewers, and prize pools that rival traditional sports.

Yes! It’s real. Esports now commands global audiences similar to football, basketball, or cricket. Tournaments like League of Legends World Championship, The International (Dota 2), and Fortnite World Cup attract massive online and offline participation.

What did it do for investors?

It opened up doors for sponsorship deals from leading brands. In 2023, the global esports business was valued at $2 billion in 2023 with estimations of $5.5 billion by 2029.

The rise of esports has unlocked multiple revenue channels:

- Sponsorships: Leading brands—from Nike to Coca-Cola—regularly sponsor esports tournaments and teams.

- Media Rights: Platforms like Twitch, YouTube Gaming, and Afreeca TV pay heavily for broadcasting rights.

- Merchandising: Esports organizations monetize fan bases through apparel, accessories, and collectibles.

- Ticket Sales: Physical arenas hosting esports finals now generate ticket revenue comparable to concerts.

- In-game Purchases: Games tied to esports events see spikes in sales of skins, passes, and IAPs.

According to Research and Markets, Twitch dominated the market, followed by YouTube Gaming, Afreeca TV, and Naver TV.

| Company | Market Cap (2025) |

|---|---|

| Tencent | $634.86 billion |

| Take-Two Interactive | $41.28 billion |

| Electronic Arts | $39.26 billion |

| Nazara Technologies | $1.43 billion |

| Better Collective A/S | $0.86 billion |

Investing in Esports Gaming

Before diving in, investors need to define how they want to invest. Esports is not a monolith but a multi-layered ecosystem:

Game Development Agencies

Studios that build esports-ready titles, multiplayer infrastructure, or custom esports experiences. A game development agency benefits directly from game sales, in-app purchases, and tournament-linked monetization.

Esports Platforms

Platforms like Twitch, YouTube Gaming, and proprietary tournament platforms generate revenue through ads, subscriptions, and streaming rights. Investors can target both established players and emerging startups.

Esports Teams & Organizations

Similar to traditional sports, investors can buy stakes in esports teams, which earn money through sponsorships, tournaments, merchandising, and media appearances.

Event Management & Arenas

With esports tournaments filling stadiums, there is an opportunity in event production, ticketing, and building specialized esports arenas.

Hardware & Accessories

From gaming laptops and consoles to headsets and specialized chairs, the demand for esports gear keeps rising. Investors can back hardware startups or global accessory brands.

Esports Monetization Models

For investors, the key to understanding the business of esports lies in how revenue flows through the ecosystem. Unlike traditional sports, esports relies heavily on digital monetization channels, supplemented by physical infrastructure and merchandising. Broadly, revenue streams can be divided into two pillars: software and digital ecosystems and hardware and physical infrastructure.

Software and Digital Ecosystem

In-Game Monetization: Software-based revenue models are at the heart of esports profitability. The most significant comes from in-game monetization, particularly battle passes and in-app purchases (IAPs). Games tied to esports tournaments often see a spike in sales of cosmetic skins, character upgrades, and exclusive passes during major events. Unlike one-time game sales, these digital purchases generate recurring revenue and keep players engaged for longer periods.

Sponsorship and Advertising: With millions of fans watching tournaments on platforms like Twitch, YouTube Gaming, and Afreeca TV, brands are eager to advertise within these ecosystems. Sponsorship deals now mirror those in traditional sports, with global giants like Red Bull, Nike, and Intel partnering with esports teams and leagues. This is not limited to in-game ads; entire tournaments are often underwritten by sponsors, providing a steady stream of income.

Subscription Models: These have further expanded digital monetization. Fans can subscribe for exclusive content, premium live-stream access, or direct support for their favorite teams and streamers. These subscriptions create a dependable and predictable cash flow, which is particularly attractive to investors looking for stable returns.

Media Rights: It represents another major digital revenue source. Just as television networks compete for the rights to broadcast sports, streaming platforms compete fiercely for esports content. Twitch remains the dominant player, but YouTube Gaming and regional platforms like Naver TV have secured lucrative partnerships. For investors, companies with strong media rights agreements represent high-value opportunities.

Hardware and Physical Infrastructure

Dedicated Gaming Hardware: While software dominates the conversation, hardware and infrastructure play an equally important role in sustaining esports growth. The rapid expansion of esports has fueled demand for gaming hardware—from high-performance PCs and consoles to gaming smartphones. Companies producing GPUs, processors, and gaming peripherals such as headsets, keyboards, and controllers directly benefit from esports adoption.

Hosting Locations: Esports also thrives on venues and event infrastructure. Just as traditional sports have iconic stadiums, esports is developing its own physical spaces dedicated to tournaments. Large arenas hosting finals attract tens of thousands of attendees, and ticket revenues often rival those of concerts or traditional sports events. Beyond tickets, these venues drive secondary spending through merchandise, concessions, and sponsorship activations.

Merch: Additionally, merchandising connected to esports intellectual property (IP) has grown into a substantial revenue stream. Fans purchase team jerseys, collectibles, and even digital merchandise like NFTs. For investors, merchandising represents a hybrid model that combines both physical and digital sales, creating multiple touchpoints for consumer engagement.

Together, software-driven ecosystems and hardware-based infrastructure form a synergistic monetization model. Software provides recurring digital revenue, while hardware and events solidify the cultural and physical presence of esports. Investors who understand and balance both aspects can tap into the most lucrative opportunities.

Why Esports Appeals to Investors

The appeal of esports lies in its ability to combine the scalability of digital platforms with the cultural power of live events, not simply game industry trends. Unlike traditional entertainment industries, esports enjoys a remarkably high growth rate, consistently outpacing film, television, and music. The global fanbase is young, tech-savvy, and deeply engaged, making it one of the most valuable demographics for advertisers and sponsors.

For investors, the cross-industry potential is particularly exciting. Esports is not just gaming; it intersects with fashion through team apparel, music through live performances at tournaments, and even education through gamified learning programs. This diversity of touchpoints makes esports a resilient sector that can withstand shifts in consumer behavior.

Moreover, the digital-first nature of esports creates opportunities for scalability with relatively low physical infrastructure costs. While building a traditional sports franchise requires massive investments in stadiums, training facilities, and broadcast networks, esports can scale globally with much lighter digital infrastructure. This accessibility makes it an attractive option for investors seeking rapid international expansion.

Another compelling factor is global accessibility. Unlike traditional sports, which are often regionally dominant, esports transcends geography, language, and cultural barriers. A fan in Brazil can watch the same League of Legends tournament as a viewer in South Korea, simultaneously consuming the same digital content and buying into the same monetization ecosystem. This borderless reach positions esports as a uniquely global investment category.

Challenges Investors Should Watch

Despite the opportunities, esports comes with its share of risks, and smart investors should be prepared to navigate them. One of the most pressing concerns is regulation. Governments worldwide are scrutinizing monetization models like loot boxes and IAPs, with some markets imposing restrictions. This regulatory uncertainty requires careful due diligence when investing in companies heavily reliant on these revenue streams.

Another challenge is player sustainability. Unlike traditional athletes, esports professionals often face burnout at a young age due to intense schedules, rapid gameplay evolution, and physical strain such as repetitive stress injuries. Shorter player careers can impact team longevity and fan loyalty, creating volatility in the ecosystem.

Market saturation is also a concern. With so many tournaments, leagues, and games vying for attention, the audience can become fragmented. Investors should look for companies that differentiate themselves with unique IPs, innovative formats, or strong brand partnerships.

Finally, there is the risk of monetization fatigue. While battle passes and IAPs are effective, over-reliance on aggressive tactics may alienate players. The most successful companies are those that balance profitability with player satisfaction, ensuring long-term loyalty.

How Red Apple Technologies Helps Investors in Esports

We act as a strategic partner for investors looking to enter or expand in the esports sector. Our expertise spans across both the creative development of esports-ready games and the business consulting required to make them financially successful.

We specialize in custom game development with features tailored for esports, such as competitive balance, robust multiplayer functionality, and scalable server infrastructure. Our mobile game development services ensure that investors can capture the fast-growing segment of mobile esports, particularly in markets like Asia and Latin America.

On the business side, we provide guidance on gaming revenue models that balance profitability with player satisfaction. Whether through battle passes, IAPs, or hybrid monetization systems, we help design frameworks that ensure long-term sustainability. For investors requiring rapid execution, we also provide options to hire game developers dedicated to their projects, enabling faster time-to-market.

By combining technological expertise with a deep understanding of the esports business landscape, Red Apple Technologies helps investors reduce risks, maximize returns, and build projects that are truly future-ready.

Final Thoughts

Esports has evolved from casual competitions into a global economic powerhouse. Its unique ability to merge digital scalability with live cultural experiences makes it one of the most exciting sectors for investors today. With billions of gamers worldwide, rapidly expanding monetization channels, and major corporations fueling growth, the industry shows no signs of slowing down.

However, success in esports requires more than capital—it demands strategic partnerships, innovative execution, and a clear understanding of the ecosystem’s dynamics. We provide the expertise and infrastructure to bridge that gap, ensuring that investments are not only profitable but sustainable.

For investors seeking exposure to the future of entertainment, esports represents a golden opportunity. And the time to act is now.

To Have A Better Understanding On This Let us Answer The Following Questions

Answer: While both esports and traditional sports rely on sponsorships, media rights, and fan engagement, esports has the advantage of being digital-first. This means it can scale globally without the need for massive stadiums or physical infrastructure. Investors can access broader international audiences and benefit from recurring revenue through in-game purchases and subscriptions—something traditional sports lack.

Answer: Asia-Pacific dominates with nearly half the world’s gamers, making it the most promising region for esports investment. Mobile esports, in particular, is exploding in markets like India, Indonesia, and the Philippines due to smartphone penetration. Meanwhile, North America and Europe offer more established ecosystems with strong sponsorship opportunities, while Latin America is emerging as a high-growth market with untapped potential.

Answer: Investors can target multiple layers of the esports value chain:

- Game publishers and studios that own intellectual property and control monetization models.

- Esports platforms and streaming services that distribute tournaments and attract massive audiences.

- Hardware and infrastructure providers, from GPU manufacturers to arena developers.

- Ancillary service providers such as analytics platforms, coaching tools, and talent management agencies.

Diversifying across these layers can help investors capture both stable and high-upside opportunities.

Answer: IP rights are critical because game publishers ultimately control the competitive ecosystem. Unlike traditional sports, where no one owns the rules of football or basketball, esports leagues are tied to the publishers who own the games. This means investors should pay close attention to licensing agreements and the long-term popularity of game titles, as IP owners have significant influence over monetization and tournament structures.

Answer: Esports offers multiple exit opportunities, including mergers and acquisitions by major publishers or tech giants, IPOs of successful teams or platforms, and licensing agreements that extend popular IPs into media, merchandise, or even the metaverse. Secondary share sales and royalties on media rights also provide liquidity before large exits occur. For investors, this variety of exit routes enhances the sector’s attractiveness compared to more traditional industries.

Book an Appointment

Book an Appointment Get Instant Project Estimation

Get Instant Project Estimation WhatsApp Now

WhatsApp Now

Book An Appointment

Book An Appointment WhatsApp

WhatsApp