Once dismissed as a niche pastime, video games have grown into the most powerful force in entertainment, surpassing film, music, and television combined in both revenue and engagement. What began as a consumer curiosity has become a global growth engine that attracts players across every demographic and geography.

For investors, the industry offers a rare combination: strong recurring revenue models, durable consumer demand, deepening technological innovation, and multiple exit opportunities. In short, gaming isn’t just entertainment – it’s a high-growth asset class that belongs in forward-looking portfolios.

The Big-Picture Opportunity

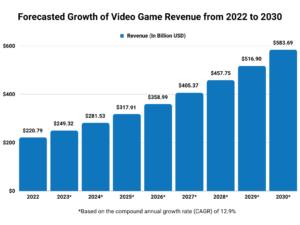

The global video game market exceeded USD 250 billion in 2024 and is on track to reach between USD 435 billion and USD 665 billion by 2030. Few entertainment categories can match this trajectory.

The drivers of this expansion are clear:

- Mobile Ubiquity: Smartphones have made gaming universally accessible.

- Cloud Streaming: Players no longer need costly hardware to access high-quality games.

- Esports Growth: Competitive gaming is pulling in media rights and sponsorships.

- AR/VR Evolution: Hardware is becoming lighter, cheaper, and more immersive.

Even with challenges such as regulatory scrutiny in certain regions or high development costs, gaming continues to scale because it adapts quickly and broadens its audience base.

Two Engines of Growth: Software and Hardware

1. Software: Predictable, Recurring Cashflows

Software dominates the value chain. Studios have shifted from one-time purchases to live-service models, where seasonal passes, cosmetic items, and expansions generate predictable, recurring revenue. This has made games resemble SaaS businesses, with cashflows that investors can model with confidence.

Mobile gaming is the largest contributor. Free-to-play titles that monetize through ads and in-app purchases are thriving across both mature and emerging economies. Partnering with an established mobile game development company allows investors to tap into a segment with proven scalability and rapid adoption.

Publishing platforms, middleware providers, and analytics firms are also attractive. These companies operate on SaaS-like multiples, often with less volatility than hit-driven studios.

Esports, while still maturing, offers cultural relevance and brand sponsorship opportunities. For investors with a long view, esports platforms represent strategic plays that complement broader gaming portfolios.

2. Hardware: Unlocking the Next Frontier

While software drives today’s revenues, hardware innovations expand tomorrow’s potential.

- Cloud gaming enables high-quality play on mobile devices, smart TVs, and low-spec laptops by shifting processing power to servers. This broadens the market and supports subscription-based models.

- Extended Reality (XR) — including AR and VR- is moving from novelty to adoption. With better hardware and richer content, immersive gaming is edging closer to the mainstream.

- Infrastructure enablers like GPUs, edge computing, and 5G are essential to gaming but also serve adjacent digital industries, offering investors diversified exposure.

For investors willing to look beyond immediate returns, hardware and infrastructure represent long-term, high-upside bets.

Why Investors Should Pay Attention

The investment case rests on three pillars:

- Resilience: Even during downturns, entertainment spending stays strong. Digital goods, in particular, carry exceptional margins.

- Scalability: Games today are global from launch, with distribution channels that reach billions of players instantly.

- Extendability: Successful intellectual properties can expand into films, merchandise, and transmedia, multiplying their value.

Institutional capital is already flowing in. Gaming-focused venture funds, private equity deals, and ETFs are proof that sophisticated investors view the industry as a legitimate, high-growth asset class.

Durable Tailwinds Driving Growth

Several forces will continue to propel gaming’s trajectory:

- Mobile ubiquity ensures a massive player base across all income groups.

- Cloud and subscriptions reduce entry barriers and improve monetization models.

- XR adoption is rising as costs fall and experiences improve.

- Games-as-a-Service increases predictability by keeping players engaged long-term.

AI-driven tools are reducing costs and accelerating development timelines. - Institutional inflows increase liquidity and create clearer exit channels.

These durable tailwinds make the sector far less cyclical than many assume.

Investor Playbooks: How to Capture Returns

Different strategies suit different profiles:

- Early-stage studios & IP: High-risk but high-reward. A breakout hit can deliver asymmetric returns. To strengthen these bets, some investors choose to hire game developers or partner with proven teams that understand retention and live operations.

- Publishing & live-ops platforms: Mid-risk plays offering recurring upside through revenue shares and tooling support.

- Infrastructure & middleware: Lower-risk, SaaS-like businesses that provide networking, analytics, and backend solutions with strong margins.

- Esports & events: Growth potential exists but requires careful selection of teams and platforms with strong monetization strategies.

- XR & hardware: Longer timelines and capital intensity, but potentially transformational upside.

Balanced portfolios often blend steady infrastructure exposure with a curated set of early-stage content bets.

The KPIs That Matter

Investors should demand hard numbers when evaluating opportunities:

- Retention (Day-1, Day-7, Day-30): Core signal of engagement.

- LTV vs. CAC: Determines if growth is sustainable.

- Paying-user conversion & ARPPU: Critical for free-to-play models.

- Session length & churn: Directly tied to monetization potential.

- Platform dependence: Over-reliance on a single app store or distribution partner is a red flag.

These KPIs separate sustainable businesses from hype-driven pitches.

Risk Management

While gaming is competitive and often hit-driven, risks can be managed:

- Diversify across studios, genres, and infrastructure providers.

- Use staged financing tied to measurable milestones.

- Prioritize teams with strong live-ops and UA experience.

- Conduct regulatory diligence upfront to avoid surprises.

Disciplined selection and risk structuring allow investors to capture growth without overexposure.

Exit Pathways

The gaming industry offers multiple liquidity routes:

- M&A: Large publishers and tech companies frequently acquire studios and platforms.

- Licensing: Popular IP can extend into film, TV, and merchandise.

- Private equity & IPOs: Growth-stage companies often attract buyouts or pursue listings.

- Secondary markets & royalties: Offer liquidity ahead of major exits.

These options provide investors with confidence that paper gains can translate into realized returns.

How Red Apple Technologies Helps Investors and Businesses

For investors looking to participate in the gaming sector, partnering with experienced development and service providers is critical. That’s where we come in.

We are a leading mobile game development company with deep expertise across platforms, genres, and technologies. Over the past decade, we’ve helped businesses, entrepreneurs, and studios build scalable products and enter high-growth markets with confidence.

Our capabilities include:

- End-to-End Game Development Services — from ideation and design to deployment, live-ops, and updates.

- Cross-Platform Expertise — mobile, PC, console, and AR/VR experiences that align with the future of gaming.

- Monetization & Analytics — helping partners design in-game economies, retention strategies, and revenue optimization models.

- Scalable Teams — investors and enterprises can directly hire game developers from our pool of specialists, ensuring faster delivery and cost efficiency.

- Future-Ready Solutions — AR/VR, metaverse applications, and gamified experiences tailored to evolving consumer demand.

By collaborating with Red Apple Technologies, investors don’t just fund an idea — they gain a trusted execution partner capable of transforming vision into a sustainable, revenue-generating product.

Conclusion: A Growth Asset Class for the Next Decade

The video game industry is no longer a speculative bet. It is a large, growing, and resilient sector with durable revenue models, powerful technology tailwinds, and well-defined exit strategies.

By pairing infrastructure and middleware plays with a selective portfolio of content studios, investors can balance steady returns with the potential for outsized gains. With the right partners in game development services and a disciplined allocation approach, gaming offers one of the most compelling investment opportunities of the next decade.

To Have A Better Understanding On This Let us Answer The Following Questions

Why is the gaming industry considered a high-growth asset class for investors?

Answer: The gaming industry surpassed $250 billion in 2024 and is projected to reach up to $665 billion by 2030. Unlike traditional entertainment, games combine scalable distribution, global accessibility, and recurring revenue models such as subscriptions, battle passes, and in-app purchases. This makes gaming resemble SaaS businesses with predictable cashflows, a key reason institutional investors are allocating more capital to the sector.

What revenue models make gaming investments attractive?

Answer: Modern gaming revenue models include:

- Free-to-play (F2P) with in-app purchases (IAPs): Driving billions in mobile markets.

- Battle Passes & Subscriptions: Providing recurring, forecastable income.

- Advertising: Especially effective in mobile and hyper-casual titles.

- IP extensions: Merchandising, film, and TV tie-ins multiply returns.

For investors, these diversified streams reduce reliance on single-hit sales and create sustainable, long-term ROI.

How do software and hardware segments differ for investors?

Answer:

- Software (short to mid-term upside): Studios, publishers, and live-ops platforms generate recurring revenue from global player bases. This includes mobile games, SaaS-like middleware providers, and esports platforms.

- Hardware (long-term upside): AR/VR devices, GPUs, and cloud infrastructure enable future growth. While more capital-intensive, they offer transformational potential as immersive gaming adoption accelerates.

Balanced portfolios often combine software’s stability with hardware’s future growth optionality.

What KPIs should investors look at when evaluating gaming opportunities?

Answer: Key performance indicators include:

- Retention (D1, D7, D30): Shows player engagement.

- LTV vs. CAC: Determines profitability of scaling.

- Conversion rates & ARPPU: Critical for free-to-play success.

- Churn & session length: Strong signals of monetization potential.

- Platform dependence: Over-reliance on a single app store is a red flag.

Investors should insist on transparent, cohort-level reporting to validate opportunities.

How are regulations and policies shaping gaming investments?

Answer: Investors should be aware that regulation is becoming a bigger factor in gaming. Governments worldwide are introducing policies around loot boxes, gambling mechanics, age restrictions, and data privacy. While this can create hurdles in certain markets (e.g., China’s strict gaming limits), it also opens opportunities for companies that design transparent and compliant monetization systems.

Working with experienced partners who understand these shifting frameworks is key. Developers and publishers that anticipate regulatory changes and adapt early will be more attractive to investors seeking sustainable long-term growth.

Book an Appointment

Book an Appointment Get Instant Project Estimation

Get Instant Project Estimation WhatsApp Now

WhatsApp Now

Book An Appointment

Book An Appointment WhatsApp

WhatsApp